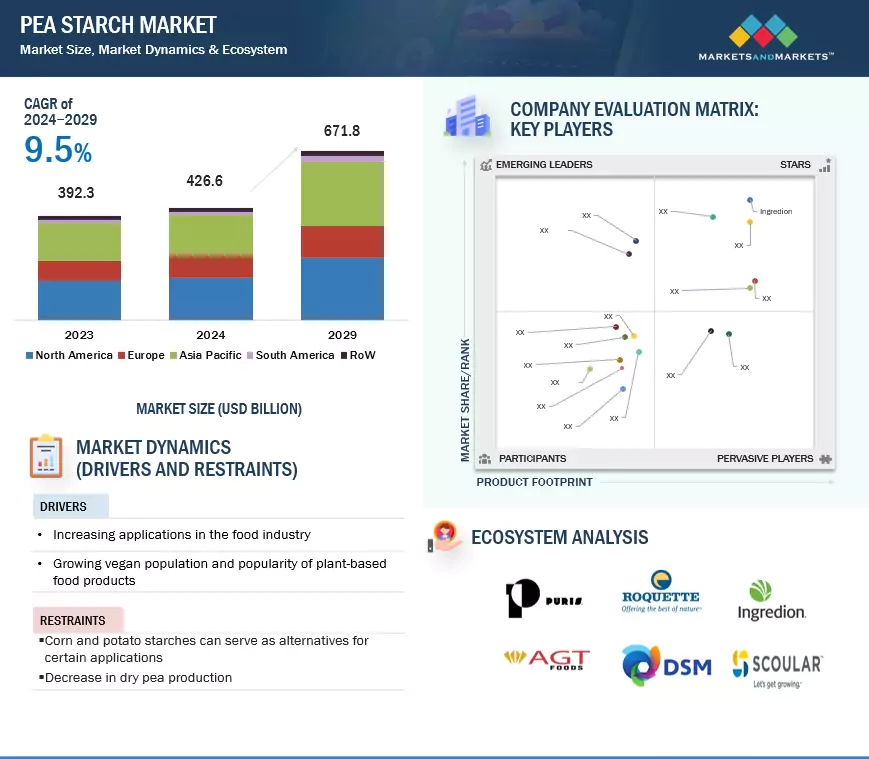

The global pea starch market is anticipated to reach USD 211 million by 2027, up from USD 156 million in 2022, reflecting a compound annual growth rate (CAGR) of 6.2% during the 2022-2027 period. This market is expanding rapidly, driven by new product launches and strategic distribution agreements. For instance, in April 2022, Puris Foods collaborated with the Upcycled Food Association (UFA), an organization focused on reducing food waste, to certify its Non-GMO and organic native pea starches. Additionally, in September 2019, Axiom Foods secured a distribution agreement with Brenntag Food and Nutrition (Germany) to market plant-based products, including rice proteins, pea proteins, and pea starch across Europe, the Middle East, and Africa. The increasing investments from pea starch manufacturers are further fueling market growth.

The pea starch market is experiencing significant growth due to the rising demand for plant-based ingredients in various sectors, including food, beverages, and industrial applications. Pea starch, derived from yellow peas, is valued for its functional properties, including thickening, gelling, and stabilizing, making it a popular choice in various formulations.

Market Drivers

- Health Trends: Increasing consumer preference for gluten-free, non-GMO, and plant-based products is driving the demand for pea starch as a clean-label ingredient.

- Food Industry Growth: The food and beverage sector is a primary consumer of pea starch, utilized in products such as snacks, dairy alternatives, and baked goods.

- Nutritional Benefits: Pea starch is a source of dietary fiber and protein, appealing to health-conscious consumers and the growing vegetarian/vegan population.

- Sustainability: Peas require less water and fertilizers compared to other crops, making pea starch a more sustainable choice in food production.

Key Applications

- Food & Beverage: Used as a thickener, stabilizer, and emulsifier in sauces, dressings, dairy products, and gluten-free baked goods.

- Pharmaceuticals: Serves as a binder and disintegrant in tablet formulations.

- Cosmetics: Employed as a thickening agent in creams and lotions.

- Industrial: Utilized in biodegradable plastics and paper products due to its eco-friendly properties.

Regional Analysis

- North America: Dominates the market due to high demand for plant-based products and a well-established food industry.

- Europe: Growing interest in health foods and clean-label ingredients supports market growth.

- Asia-Pacific: Rapid urbanization and increasing health awareness are driving demand, particularly in China and India.

Challenges

- Competition with Other Starches: The pea starch market faces competition from other plant-based starches, such as corn, potato, and tapioca starches.

- Price Volatility: Fluctuations in raw material prices can affect the cost of pea starch production and its market pricing.

Future Outlook

The pea starch market is expected to continue its growth trajectory, driven by the increasing demand for sustainable, health-oriented food ingredients and innovations in processing technologies. Investments in research and development will likely lead to enhanced properties and new applications for pea starch, further expanding its market potential.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=78961382

Consumer awareness about nutritional benefits offered by pea and pea-based products

Green peas are packed with essential minerals that support cardiovascular health, including magnesium, potassium, and calcium. Yellow peas, on the other hand, are high in fiber, which aids digestion. Dry yellow peas are also rich in lysine, iron, and carbohydrates, making them a viable alternative to other legumes like wheat and rice. The popularity of pea and pea-based products is rising due to their nutritional benefits, including vitamins C and E, zinc, and various antioxidants that enhance immune function.

Pea starch, constituting 30%–60% of the dry weight, serves as a valuable food ingredient. It contains a higher proportion of amylose compared to other starches, offering numerous advantages such as excellent shear-thinning resistance, elevated gelatinization temperatures, high gel elasticity, and rapid retrogradation. This makes pea starch an effective raw material for enhancing the consistency and texture of food products. Its gelling and binding properties, attributed to its high amylose content, set it apart from other starches like potatoes, corn, and wheat. As the demand for starches in canned foods and extruded snacks continues to grow, the use of pea starch is expected to increase in the coming years.

Growing vegan population and the popularity of plant-based food products

Consumer dietary preferences are undergoing a significant transformation worldwide. There is a growing inclination toward non-meat and non-animal-derived products, including milk and milk-based items, which has resulted in increased demand for pea-based ingredients like pea protein and pea starch. Several key factors have contributed to this shift, including health issues such as lactose intolerance and meat allergies, along with a heightened awareness of health and wellness among consumers. These factors have motivated individuals to opt for plant-based proteins and starches that are free from allergens.

The trend toward plant-based proteins is supported by a UN report from August 2019, which highlights the potential benefits of plant-based diets in addressing climate change. The report estimates that approximately a quarter of global greenhouse gas emissions come from food products, with over 26% attributed to this sector, including more than half (58%) stemming from animal products, particularly beef and lamb. According to the World Population Review, in 2019, the UK boasted the largest vegan population, followed by Australia, Israel, New Zealand, Switzerland, Austria, Germany, and Sweden.

List of Top Pea Starch Companies

- Emsland Group (Germany)

- Ingredion Incorporated (US)

- Roquette Freres (France)

- Vestkorn (Norway)

- Axiom Foods (US)

- COSUCRA (Belgium)

- AGT Food & Ingredients (Canada)

- Puris Foods (US)

- NutriPea (Canada)

- Organicway (China)

Schedule a call with our analysts to discuss your business needs:

https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=78961382